Guest of the Stable: Donna Antonucci

|

| Click to enlarge |

|

| Click to enlarge |

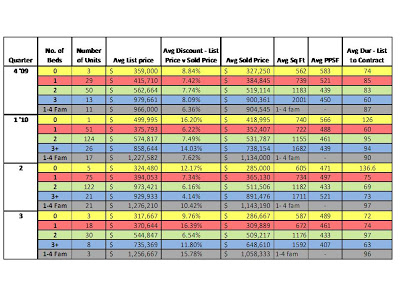

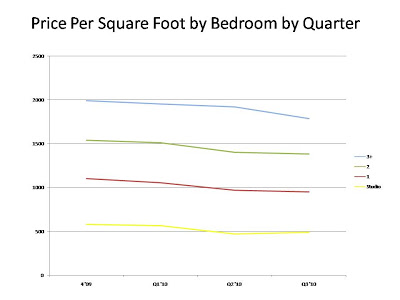

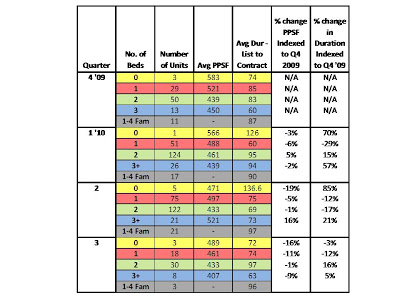

The percent change in the Price Per Square Foot from the beginning of the year is significant. You do have to keep in my the number of units sold in the comparison. Although this is the complete set of transactions i.e, not a data sample, when the numbers are low one slightly odd transaction can throw off all of the averages. I like to look at 1 and 3 bedroom sales to understand the direction of the market because, the largest volumes are in these 2 categories. Then I would compare how they did relative to each other as there are distinct markets in Hoboken for 1 Bedrooms, v. 2 Bedrooms and 3 or more. 1-4 family sales are also a market unto itself and will be reviewed in a follow up article.

Interestingly, 1 bedrooms have taken the biggest hit in comparison to 4th quarter with an 11% drop in price per square foot. I think it’s fair to say that this is because of the end of the Obama $8,00 First Time Home Buyer credit. Although the program was discontinued on April 30th, as long as a buyer had a unit under contract by April 30th but closed by June 30th, he/she could still take advantage of the tax program. Net, net, Q3 was the first quarter where buyers did not have that as an option and we can see it in the drop off in price per square foot in the smaller “first time home buyer” units, i.e. the one bedrooms.

|

| Click to enlarge |

|

| Click to enlarge |

The duration of a unit on the market has generally gone down from Q4, ’09. This just signals that buyers and sellers are coming together more quickly. It may be that sellers are becoming more realistic about property values and if they do sell they are more willing to recognize what their place is worth and getting to it sooner.

It’s fair to say the market is slowing as we go into the Fall Season. Are buyers waiting to see what happens with employment and interest rates? As we know, mortgage and other interest rates are being held down by the Federal Reserve. Many feel this is not sustainable. What will happen to home prices if interest rates go up? Unless we have a booming economy that means that prices will go down.

In my office, we have watched a number of clients withdraw their units from the market because they could not sell at an amount that would cover their mortgage or be enough to buy that next step up. They preferred to stay put or rent if they had to move.

Business trails off starting in November and only a handful of customers start their search in December. I will take another pulse in the beginning of November to see how the Fall market is trending. The Summer however was not a day at the beach…..

See Hoboken Real Estate Monitor.com for previous quarterly analyses and other articles and resources focused on the Hoboken Real Estate Market.

Provided by Donna Antonucci

Prudential Castle Point Realty

201-240-6832

donnaantonucci@gmail.com

http://www.hobokenrealestatemonitor.com/

http://www.hobokenrealestatevalue.com/

http://www.donnaantonucci.com/